In The Future, Banks Will Not Be Built With Bricks But On Cryptography

In The Future, Banks Will Not Be Built With Bricks But On Cryptography

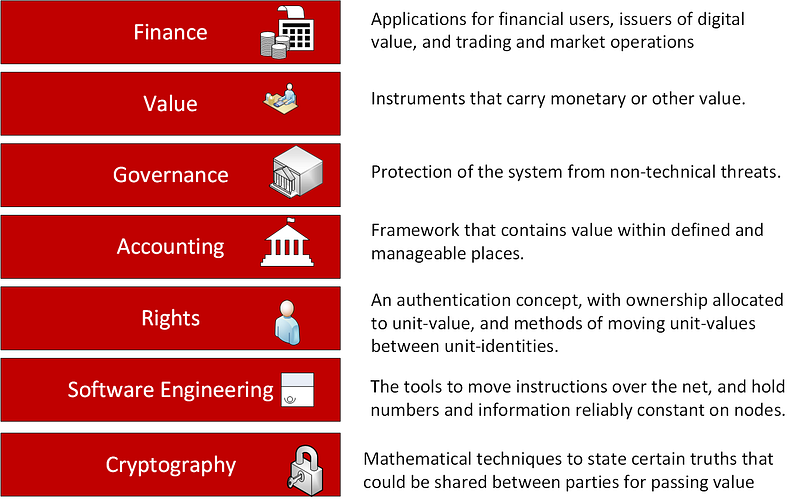

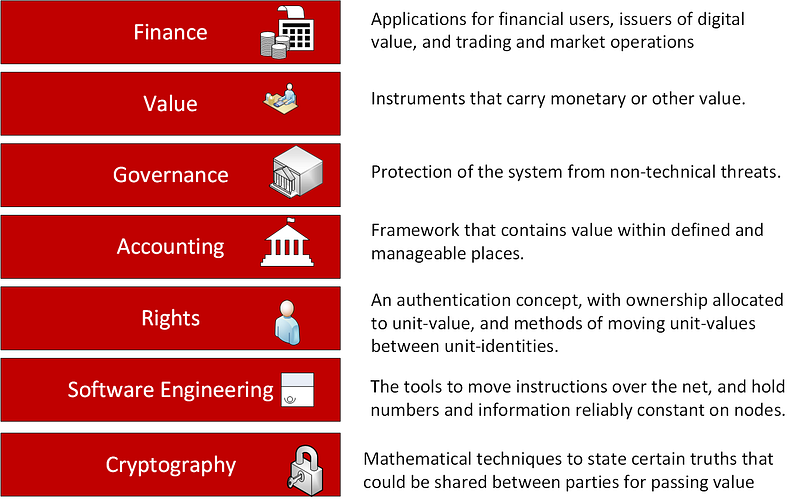

I have been reading a paper from 2000, and which defines a seven layer model for Financial Cryptography [here]. For this the paper outlines a seven layer model for finance and which takes its inspiration from the 7-layer model used in networking:

Building on a solid foundation

As someone who has studied, and taught with, the ISO OSI (Open Systems Interconnect) 7-layer model, I find that it is an approach that allows you to abstract networking and Internet connections within different layers.

For networking, we can view the Ethernet data frames at Layer 2, IP packets at Layer 3, and segments in Layer 4. We can then define that systems then communicate within an application layer. This, thus, allows for systems to be interconnected with a layer approach, and which also simplifies the overall infrastructure. We can design, test and debug in whichever layer is best for our abstraction level.

With the guidance of the ISO 7-layer model, we have built the Internet on the physical and data link layers. And so, perhaps we need to make sure that all our finance systems are built on a cryptography layer? This will give us core proof that the foundations of our finance industry has a built on a solid base, and not just derived from the legacy of previous generation. And only with properly implemented cryptography, distributed ledgers and Merkle Trees can we really be sure that we are building on a solid foundation.

The Bangladesh Bank hack on the Swift network highlights the core problem, as it was also discovered because of a typo in the name of a destination. In no way can this be seen as having any form of proper trust. Our accounting and auditing approaches too have been built on monthly, quarterly and yearly cycles, but, if we build on a strong layer of cryptography, we should be able to have “by the second” accounting and auditing.

A new foundation for finance

If we are to properly move into an information age, there must be minimum standards applied at the lowest layer. For this, every transaction should be encrypted, every transaction should preserve privacy, every transaction should be digital signed, every transaction should be accounted for, and the complete state of the financial infrastructure of local and global systems must be known at every instance of time.

The tools and the know-how are there, and a future system will know — almost to the minute — the current state of every transaction which happens within each financial infrastructure, and where every state is known.

We, too, in an era of GDPR, need to make sure that this lowest layer — the foundation layer — respects privacy and consent, while provides all the mechanisms that are required by the upper layers … governance, accounting, rights, and so on.

With this we will be able for innovate companies to properly build on the solid foundation and focus their efforts on their core expertise. For many this can be likened to the days when the might Big Blue (IBM) ruled over the computing industry. IBM built every part of their system, and forced the standards across the industry. The 7-layered OSI broke that monopoly, as it allows different manufacturers to integrate into specific layers, and make sure that the systems could interconnect. The move toward distributed ledgers and in the application of cryptography is thus the moment that the finance industry will build its new foundation.

One area that I think the finance cryptography model differs from the OSI model is the requirement to expose things from layers which are not directly above or below the current layer. In the OSI model, for example, the application layer (Layer 7) does not see any of the data link layer details (Layer 2). But, in a finance cryptography model, it is important to expose details from other layers, in order to create an integrated system:

The debate is over

The debate is over, now lets just get on with it. Financial organisations which can move the fastest in building this, and making should their foundations are solid, will be the organisations which will benefit most. Those who do not change, will become a fossil of the 20th Century.

Our whole infrastructure around finance needs to change — governments, auditors, accountancy and legal services — and we now need to build a robust infrastructure, as our financial infrastructure could come crashing down in a single instance. This needs to stop being a technical debate around blockchain and cryptocurrencies, and be one built around society rebuilding its world around digital technology. This has been the fastest era in our existing, and it needs to be built properly.

The speed and scope of hacks these days could cause our global finance infrastructure to crash in seconds, so we need to improve our foundation, and thus support our future generations to make full use of the foundation we have build for this.

Many will define the “FinTech industry” as a companies which are creating a finance-related applications, but, for me, properly innovative FinTech companies are aiming to disrupt existing methods and thinking, and build on a proper foundation of trust. They should thus have little in the way of baggage from the past, and will be building with the latest software engineering methods (Node.js, Python, Cassanda, GitHub, Docker, and so on), cryptography and distributed ledger methods.

So, forget the whole Bitcoin/cryptocurrency debate, and focus on building our data world, in the same way we built the Internet. In a decade this new world will exist, and we will look back on our existing systems in the way we look back at 56k modems in a world of Gigabit switches. Those who stick with the equivalent of 56K modems in this data-focused world, will not exist in 10 years time.

The concepts of simple check-sums, transactions coded with numbers and characters, and auditing that can take months, needs to be retired as quickly as we can make it. We also can’t rely on governments to make this change, as they have little idea as to why the change is needed, so companies need to get on, and innovate like the have never done before.

If you are interested on what’s involved in this foundation, here’s the wonderful Merkle Tree: