Meet The Greatest Threat To The Global Banking Industry … (Facebook) GlobalCoin

Meet The Greatest Threat To The Global Banking Industry … (Facebook) GlobalCoin

Facebook will launch GlobalCoin in 2020 in a number of countries around the world. It’s all part of their move away from the reliance on social media, and is likely to make Facebook the largest clearing bank in the world.

The Central Bank of Facebook

Okay. Let’s create a new bank. “But”, you say, “You don’t have any customers, and it’ll be too costly to get them!”, “Well, let’s say I have the potential to attract 2.7 billion customers, would that work?”, “Yes, of course!”. “But, how would you get trust?”, “Well, I issue receipts for IOUs that you bank will pay, in whichever bank and/or currency that you want!”. “But, how can I trust that they will pay it?”, “I will put the money away somewhere, so you can get it back, but you can also transfer the IOU to someone else, if you want”, “Okay. Isn’t that just what we do just now with money?”, “Yes!”.

And so it is Facebook that is looking to use its captive base of 2.7 billion users — on Messenger, WhatsApp and Instagram — to launch its own cryptocurrency and become the Central Bank of Facebook. If successful, it could become the largest clearing bank in the world. Facebook, itself, sees competitors such as Telegram rising as a threat to its instant messenger platforms, and needs ways to innovate in the space and use its current captive user base to build new business models.

The FaceCoin

So, let’s give the new “currency” another name … FaceCoin.

And how would it be able to get users on its side, and become trustworthy as a bank? Well, it is likely that Facebook will peg the value of FaceCoin to a range of fiat currencies, and then have enough cash in reserve to cover a refund for all the coin, in the case of everyone returned them. It is a model which the world currently uses for its financial infrastructure, and, if successful, Facebook would become the largest central bank in the world. Also it would change our financial world in an instance, and where many of our existing methods of transferring money would seem archaic.

It is thus another move towards a tokenized world, and where there is no need for a third party to settle a transaction. Bob the Buyer can cash in and out of FaceCoins whenever he likes. He might thus have some FaceCoins in reserve for his purchases, and his exposure to fraud will just be the number of coins he has in his wallet. Alice the Seller can have any funds directly into her wallet, and cash out whenever she likes. It is a world without the requirement for Trent the Banker (apart from the exchange of the FaceCoin into fiat currency).

The need for Visa, for example, would thus diminish, and a transfer to funds from Bob the Buyer to Alice the Seller would happen in an instance, and be settled without the requirement for the payment to clear. Bob would have his FaceCoins and know the value of these, and Alice would know how much had been payed, as she can cash out whenever she wants.

For the tax authority, too, this is a good solution, as there is instant auditing, and no fluctuation of the currency, so that the valuation is fixed on each transaction, and both Bob and Alice can account for it. There would be no need for bank statements for the cash out process, as the transaction itself would show the transfer. In fact, we would have instant auditing the system. It could thus be a world without credit cards, and where your options might be to pay with Visa, MasterCard or FaceCoins. There would be no need to enter credit card details any more.

So what’s the downsides?

But … what is the advantage for Facebook? They will not make any profit on the distribution of their coins, as they must put the money away in an exchange to cover their value. Well, the business model is really the holy grail for any social media company … find out what the user is buying and feed them advertisements. Facebook would then know at what time you bought your coffee from Starbucks, and then push you adverts within a loyalty scheme. They could also track your on-line activity to your actual purchases, and see if the adverts they push in your way will result in a end purchase.

Basically it becomes the World of Facebook. A world of instant payments. It is not a new idea, though, and even the Bank of England has been looking at a pegged version of the UK Pound. But, it would be a massive change within e-Commerce, and where there was little need for banks to be involved in the purchasing and sale of goods. Banks would then only be involved with the storage of fiat currency.

But, what about regulation? Could the coins be traded by drug dealers in order to launder their profits? Well, the FaceCoin would have to anonymise the transaction in some way, but use a way to reveal it for its trustworthiness. As the currency is pegged to a fiat value, it is useful for money laundering, as a criminal with not reduce their profits by moving it into the risk cryptocurrency space. To much control by Facebook to regulate the users of their coins would create a monopoly situation and reduce the scope of their transactions, and thus Facebook could not limit the coin to their users. In this way, criminal could create short term accounts, in order to move money through these accounts, and then out into the fiat exchanges.

Governments losing power?

Governments are extremely worried about cryptocurrencies such as bitcoin. These virtual currencies mean you can make payments without involving the banks that most economies and government financial models are built on. People can transfer large amounts of money without the authorities knowing, potentially making it easier to evade tax or launder money.

So several countries’ central banks, including the Bank of England and the Bank of Israel, are reportedly planning to launch their own digital currencies. This could help lure people back into using an official system that combines some of the benefits of both traditional and cryptocurrencies. But the risks involved may be too great for many typical cash users to bear.

One of the major drawbacks of existing cryptocurrencies is that their value tends to swing widely and it is often difficult to pinpoint how much they are really worth. National cryptocurrencies would be tied to the value of the country’s official currency, making them less volatile and easier to actually use as a way of spending.

National cryptocurrencies would also make payments much faster because transactions would be recorded instantly and wouldn’t have to be cleared by a bank (although some implementations require around eight minutes to be verified). The existing systems for electronic payments and transfers can often involve several banks and companies sending each other data and running security checks that add time and expense to transactions. Cryptocurrencies are able to bypass this clearing process altogether because they don’t actually involve transfers from one entity to another.

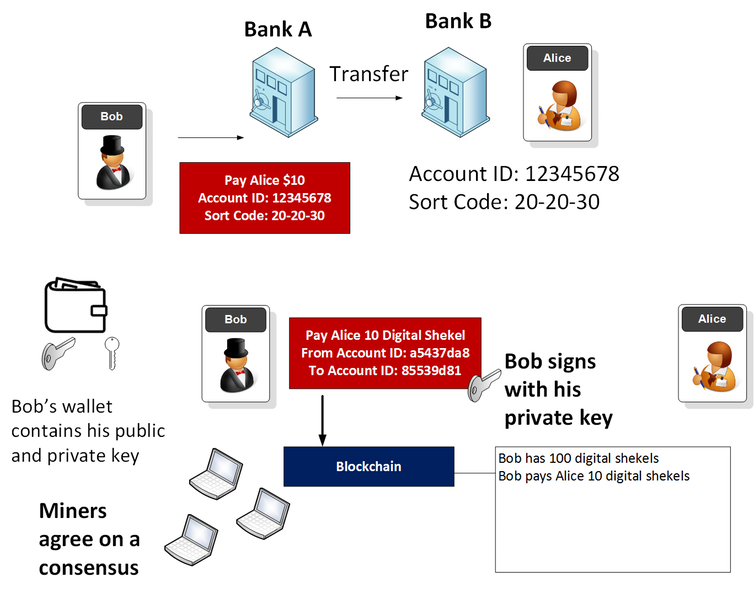

Instead they use a technology known as a blockchain, which keeps a public but encrypted record of all transactions. Basically, as illustrated in the figure below, the payer (in this case, Bob) signs a transaction to agree to pay someone (Alice) a given amount. The transaction is then validated using Bob’s personal encryption code known as his “private key”. If the transaction is valid, it is added onto the blockchain, recording how much money Alice and Bob now have.

Because all transactions would be recorded in this way, the government would have much greater oversight of who is paying whom and how much, helping to crack down on financial crime. Unfortunately, because transactions on blockchain ledger are typically kept as a public record, it might also be possible for other people to access this information and see how much you or anyone else is spending and what you’re buying.

Your money might also be at greater risk if it’s stored as a cryptocurrency. Currently banks guard your wealth and will always release it if you can prove your identity, while credit card companies insure you against fraud. If your bank account is hacked, there is a good chance you will get your money back. But cryptocurrencies store money in independent digital wallets that can be lost or broken into. If that happens there is no one who can help you.

Trust

The major thing here is .. TRUST … who do you really trust to hold and transfer your money? Many of our financial institutions have existed for centuries, but now face pressures for new ways to transact. Do people trust Facebook to be a “bank”? There are many questions that are unanswered, but it will be interesting to see how things are evolving. One thing that is for sure, is that we are now moving into a world of tokens.

I believe that most countries will deal with cryptocurrencies by regulating them and monitoring their use rather than co-opting them. But it will be interesting to see whether regulation or competition will win in the battle of crytocurrencies. While the encryption of crytocurrencies can create strong digital trust in the technology, human trust in the transactions themselves will likely be the key factor that determines whether citizens adopt government-backed cryptocurrencies.

One thing is for sure … our old road is rapidly agin’.