What is the Killer App for CBDC? Perhaps Programmability?

What is the Killer App for CBDC? Perhaps Programmability?

I was honoured last night to present at the Business School of the University of Edinburgh on CBDC (Central Bank Digital Currency), and was on after Aggelos Kiayias (which is not an easy act to follow — and my first time in hearing the might Professor present on cryptography). What I loved is that the audience mixed those focused on finance and those who did cryptography for a living. These types of events are often the best places for knowledge exchange and debate and where each side can present viewpoints to the other.

Fundamentally, our finance industry is one of the most important elements of our lives and economy, and we must do everything we can to improve and advance it — but not take risks with our future. And, the city that brought the world an enlightened way of thinking, seems to be the right place for building an enlightened approach to finance.

If you are interested, the digital pound is likely to use the approach of the central bank (the Bank of England), maintaining a privacy-aware ledger on all the transactions related to the digital pound, and where Alice will have a wallet that integrates with intermediaries (such as her bank).

If you are interested, the digital pound is likely to use the approach of the central bank (the Bank of England), maintaining a privacy-aware ledger on all the transactions related to the digital pound, and where Alice will have a wallet that integrates with intermediaries (such as her bank):

My opening statement was one that criticised the 20th Century methods we use in the finance industry, especially with the weaknesses of the Swift network. An example of this related to the fraud of $81 million on the Banglasesh Central Bank, and where a further $20 million transaction was stopped because someone noticed that misspelling of “foundation” as “fundation”:

My starting point is that we need to use public key encryption within our finance industry for our transactions, and where every part of the transaction must be trustworthy. Along with this, I stated that CBDC is not a cryptocurrency — it is a method of making transactions trustworthy (and private, if required).

For CBDC, the interface between the intermediate and the Central Bank is then done through a trusted API interface, and where a Zero Knowledge Proof (ZKP) allows Alice’s identity to be shielded:

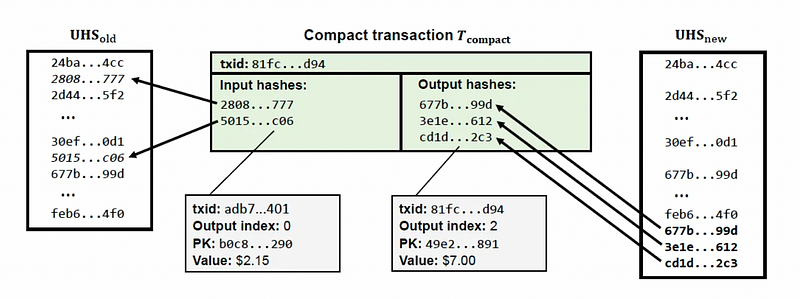

The proposed method decouples fund checks with transaction validations. Funds are stored as a 32-byte hash value with an Unspent funds Hash Set (UHS). The transaction has a similar format to Bitcoin:

One of the great advantages will come with programmability, and where we can bind a transaction with the implementation of a contract:

But I talked about the downsides of CBDC, and where banks will not be able to loan the funds in digital wallets:

And of a run on a bank, if there was bad news about the digital pound, and where a market could crash almost in an instance:

And where the cybersecurity element of the infrastructure would be key, especially in attacks on the digital wallets, on the intermediatary and on the central bank:

And many challenges still exist, such as making off-line payments:

In providing threats:

and in Denial of Service attacks:

But, I think all of these issues can be overcome if we get together and find a strong technical solution.

Survey

And, so, did the audience thing CBDC will happen? Well, it was a maybe:

And, should the digital pound be cryptocurrency? And, the answer as a strong No!

But, when will it happen? Well most think it will be at least five years in the making:

And, the main risk? Well, there are lots, but privacy and cybersecurity seem to be top of the agenda:

And, too, for the barriers to citizen adoption:

And the advantages for the banks seems to be more efficient transactions:

And, the killer app … programmability:

Conclusions

Bring it on … and let’s build a finance industry for the 21st Century.