In A Goldrush, Sell Shovels

In A Goldrush, Sell Shovels

6 of 7 top companies in the world are tech companies

I have a presentation in Glasgow on Tuesday, and outlining AI and Cybersecurity — both the risks and opportunities [here]:

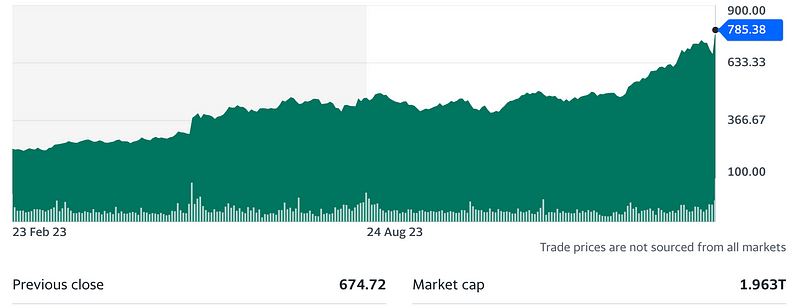

Like it or not, we are in a gold rush for AI and Machine Learning — A Gold Rush. And, when you are in a gold rush, you sell shovels. In this gold rush of AI, the maker of shovels is mainly NVIDIA, and, yesterday, saw the largest single-session market capitalisation increase for a publicly listed company. Its share price increased by 16.4% with an increase of $276.7 billion, and the one day increase is worth than the Bank of America and Coca-Cola ($265 billion). This follows Meta’s one-day increase of $196 billion on 2 Feb 2024.

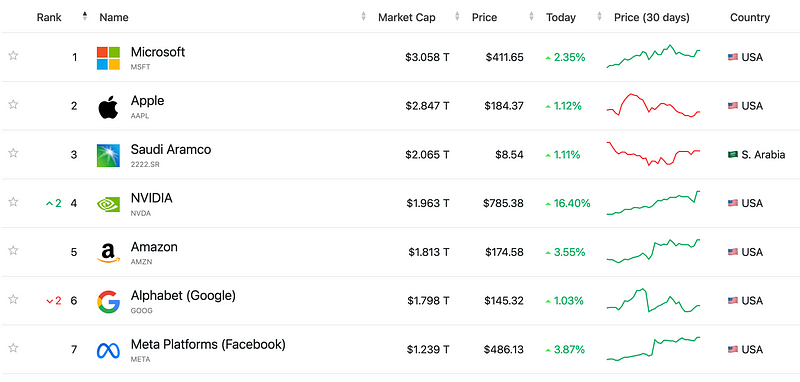

Impressively, the surge in Nvidia’s market value even exceeded the entire market value of Coca-Cola, which stands at $265 billion. Six of the Top 7 companies in the world are technology companies:

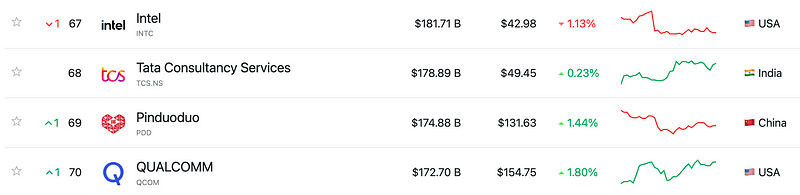

NVIDIA now have a market capitalisation of $1.863 T, and is built on their 80% share of the AI chip market. This looks all the more surprising in that Intel’s valuation has dropped to $181 billion:

Sometime, soon, Qualcomm may pass Intel in terms of valuation.

Intel lost the opportunity

Motorola was a true innovator, but it crashed, and where Intel succeeded. At the time of the rise of the microprocessor, Motorola (with its 6800/68000 series) had a much better processor than Intel (the flawed 8086 series). But, Intel had two jewels in its crown: being selected for the IBM PC, and András István Gróf (Andy Grove).

Andy continually fretted about future markets and threats — and built a company that had a focus that few other companies could ever match. Initially, he took Intel out of the crowded DRAM market and focused the company on microprocessors. At the time, he could see that what engineers needed was development kits, and Intel made sure that these were created to allow system designers to use their processors in the design of new systems. It was a bold move for a company that invented DRAM.

But, is Intel now failing? Well, after Andy left the company, they have generally moved from an engineering focus to a profit-focused approach — and in maximising the returns from their x86 architecture. They have since missed the mobile processor market, missed the communication chip market, and missed the GPU/parallel processing market.

In GPUs, NVIDIA created the CUDA core for free. But which only runs on their chips, and thus locked out Intel from the GPU market. But the great threat to Intel comes from companies that do not need to spend funds in making chips: they just design them and others to build them.

QualComm saw the opportunity in communications chips, and which mixed analogue and digital electronics. And ARM focused on licencing its technology for others to create. But, the greatest threat to Intel, comes from Apple, and which now designs its own chips, and then hands them over to others to manufacturer. While this creates supply chain risks for Apple, it allows them to focus on continually improving their hardware, and not waiting for Intel to advance their systems. Anyone who uses a Macbook with the ARM-based chip will know that it generally wipes the floor with the equivalent x86 processor.

Broadcom, too, has accelerated past Intel, with a position that puts its value more than Visa:

What went wrong? Intel focused on general-purpose with the CPU, and which is not well matched to more specialist AI and cryptography methods. NVIDIA saw the AI market coming and focused on making their chips well-matched to machine learning. How did this happen? Well NVIDIA saw that some PhD students were using their GPUs to run AI algorithms .. and they have since matched their chips to these requirements. The company have bet to the future on AI, and to allow others to manufacture their chips.